No Collapse Is the Real Dystopia

Source : unz.com – June 10, 2023 – Robert Stark

https://www.unz.com/article/no-collapse-is-the-real-dystopia/

Illustration : George Orwell and Aldous Huxley

Abonnez-vous au canal Telegram Strategika pour ne rien rater de notre actualité

Pour nous soutenir commandez les livres Strategika : “Globalisme et dépopulation” , « La guerre des USA contre l’Europe » et « Société ouverte contre Eurasie »

So far the 2020s seem more chaotic than previous decades. Based upon current events, economic and sociological data, and looking at historical cycles like the 4th turning theory and Peter Turchin’s research, it looks like there will be a major historical crisis this decade. In contrast, the 2010s felt very stagnant, despite the recession at the beginning of the decade, and political movements such as Occupy Wall Street, nationalism and populism in Europe, the Donald Trump and Bernie Sanders movements, and the beginning of the Great Awokening. Looking specifically at years, 2016 was a turning point with the election of Trump, 2017 was somewhat chaotic with political strife between antifa and the alt-right, then both 2018 and 2019 felt very stagnant. Obviously 2020 was a chaotic year with the pandemic, as well as the BLM riots and acceleration in woke politics and cancel culture, with certain moments feeling apocalyptic. However, with the exception of Jan6th, 2021 was another stagnant year, with covid easing and the peak of the stimulus bubble and market euphoria. Also in 2021, the right was totally demoralized and cancel culture had become the new normal. There was some return to chaos in 2022, with the onset of inflation and the Ukraine war. While this year has seen a banking crisis, dept default scare, migrant crisis, more political turmoil such as the inditement of Trump, and increased political instability overseas, overall things feel stagnant again, or perhaps a calm before the storm.

The perma bulls just won’t give up

It initially seemed that the Silicon Valley Bank crash would put an end to copes about economic recovery. Despite recent fear of a debt default, major vulnerabilities in the financial system, higher interest rates, unprecedented levels of debt, sticky inflation, and the worst yield curve inversion in over 30 years, there is still a lot of bullish propaganda. For instance talk of a mild recession, soft landing, a new bull market, and that we may have even dodged a recession altogether. The bulls’ basis for optimism is a combination of the debt ceiling deal, official unemployment stats still being low, a slight dip in inflation, and hope for a pause in Fed rate hikes. Not to mention the new cope of an AI boom saving the economy and ushering in a new bull market, which is just creating another bubble in stocks, on top of the existing super bubble. This propaganda is in line with Janet Yellen’s infamous statement that we will never have another financial crisis again in our lifetime, the arrogance that the system is perfected to withstand collapse. The cringiest bull take so far, is that the economy is doing great because of the exorbitant prices for Taylor Swift concert tickets, as obviously there are many affluent girls who use Daddy’s credit card to buy tickets. If anything this just further shows the scope of the debt bubble, and high levels of income inequality. The current vibes remind me a lot of January’s bullishness before the banking crash, though we will probably see some repeat of cycles of coming close to the imminent crash, followed by more copes of a recovery, before the inevitable big crash.

While bears have been vindicated, looking at the overall trajectory of the economy, there have been times over the past few years, when bears appeared wrong or overshot their predictions about the severity of an impending crisis. For starters, expecting that covid would cause a depression, which did not anticipate stimulus propping up the economy, at least for the time being. There was also concern, including from the mainstream media, that the Ukraine war was going to cause a global famine, the worst in modern history, by last fall. However, there was a successful deal, negotiated by Turkey between Russia and Ukraine, to allow the safe shipments of Ukrainian grain through the Black Sea. The question is whether a prolonged conflict, delaying Ukraine’s planting season, will mean a global famine within the next few years. There were also expectations that Europe would have a catastrophic energy crisis last winter, which also did not pan out. Even Russia limiting oil production did not spike oil prices as high as anticipated. Europe lucked out by having a mild winter, and enough petrol and natural gas saved up in their reserves, and extra help from America, as Biden depleted America’s strategic petrol reserves. Overall it was a combination of certain supply chain issues getting resolved from the pandemic and war, but also a decline in global demand, and just kicking the can down the road.

In order to have a healthier economy, it is necessary for super bubbles to pop, and a similar case can be made for social and political ills. Since the pandemic mostly exacerbated the worst trends of the 2010s, such as social atomization, the mental health crisis, the sex recession, income inequality, the establishment consolidating power, cancel culture, cultural decay, and overall cringe, the question is whether a severe economic collapse would clear out societal bullshit or just make these problems worse. An economic soft landing or stagnation scenario would likely exacerbate the worst existing trends, so I totally get the doomers and accelerationists who cheer on the collapse. However, dissidents, who are often in despair, or feel that the current system is stacked against them, have this fantasy cope, that when the big collapse occurs, either they or their ingroup will do better or be liberated from systems of oppression, which is incredibly naïve. Dissidents have no institutional power and this doomer mentality is very passive, primarily fulfilling a psychological need. If one’s life and inner psyche is in chaos, one tends to want to see the cold indifferent society around them collapse as well.

Doomers rely upon this fantasy that one external shock to the system, or Black Swan event, will cause the entire system to come crashing down like a house of cards, but the system has shown itself to be much more resilient than that. California shows that a one party liberal hegemonic system can last much longer than one would think, though it has been sustained by Silicon Valley revenue, and the exodus of the middle class acting as a safety valve for discontent. The financial propagandists who talk of a soft landing are partially correct, in that it is a soft landing or no recession for those at the top. In fact, America is working great for the people who run it, but not for those with no power and influence. The incoming severe recession may just mean more urban blight, homeless encampments, increased deaths of despair, and widening income inequality, but not necessarily a collapse of institutional power.

Anonymous 4chan post from 2013

The prophet of despair, Michel Houellebecq, has been totally vindicated in his prediction from the beginning of the pandemic that post pandemic life would be “the same but worse.” Collapses are often gradual and not overnight, and not necessarily a Mad Max scenario, but rather collapse just means a lower quality of life for most people. This is even true for third world nations that have collapsed, like Sri Lanka, or with the current high levels of inflation in Turkey and Argentina. “The nightmare is not the “collapse.” The nightmare is that they pull off the End of History, and things just gradually get worse – more crime, more poverty, more degeneracy, fewer services, and a population incapable of anything other than demanding larger doses of the poison,” tweets VDARE’s James Kirkpatrick. Basically a gradual decline in people’s quality of life or a frog in the boiling pan scenario, where people just get used to degradation, and may never actually reach that breaking point but rather merely adjust their expectations and standards. Dissidents rely upon this fantasy of the masses awakening and rebellion, but with lower wages and higher unemployment, there is just greater leverage to those in power and less to the people. The political elite must factor in that some type of economic crash means that people will be desperate enough to work for little or nothing and give up their freedoms and autonomy. The question is whether Americans, especially middle class Whites, can psychologically handle the decline and transition to a post-American order?

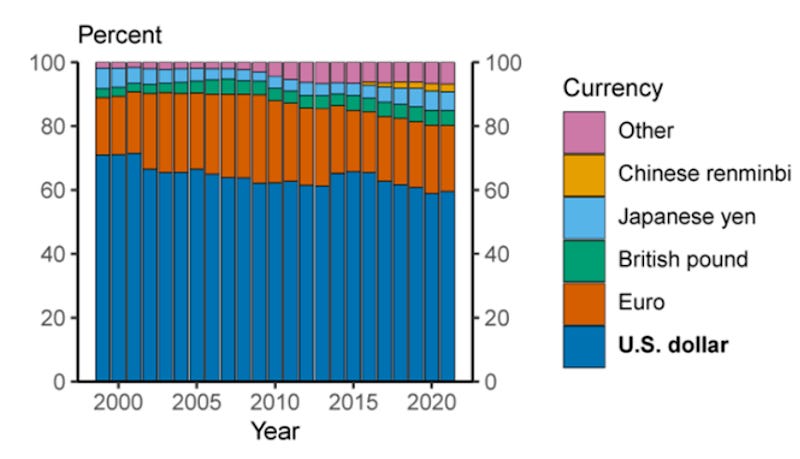

Federal Reserve Chart of change in Foreign Exchange Reserves

A probable scenario is where the US economy has a quasi-soft landing but at the expense of the rest of the world, by abusing the reserve currency to export inflation abroad. For instance, nations being forced to play catch up with the Fed’s rate hikes in order to save their currencies. This will accelerate the migrant crisis and increase resentment against America, with the potential for retaliation against the dollar. America would go into a depression, if it lost its reserve currency status, but the dollar still dominates foreign exchange reserves, with no clear competitor. On a similar note, an AI boom could turn the economy around after the recession, perhaps even a period of rapid economic expansion, but would also exacerbate income inequality and gradually erode the value of labor.

While there will likely not be a debt default anytime soon, the main danger now is the Treasury being forced to sell treasury bills and bonds, which would drain liquidity in the financial markets, thus exacerbating the banking crisis, push commercial real estate over the edge, and cause a pension solvency crisis. Not to mention, exacerbating the financial trap that the Fed is in, where if the Fed pivots or bails out the banks, inflation resurges, but if rates are kept high, there will be a liquidity and debt default crisis. Whether this will be the financial event that causes the big crash is hard to say. Overall, the main vulnerability in the economy is the sheer levels of debt, both public and private, in which the response will likely be inflating the dollar to pay off massive debts.

The crash has taken much longer than anticipated, like watching paint dry, and I am done trying to guess when this mega crash will occur. Generally I take the view that the economic bubble is just being propped up further, and that the inevitable is being delaying, which will lead to a much worse economic crisis. However, what if this is all part of a successful managed decline, or manufactured stability, which is really depressing and demoralizing. America is in decline but it is a stretch to say collapse, but rather a long term multidecade process, a slow motion decay, analogous to Rome’s decline as a late stage empire, which took a very long period of time to fall. America has both advantages over other nations and major vulnerabilities.

(Republished from Substack by permission of author or representative)